US Trend Strategy

SINCE 2018

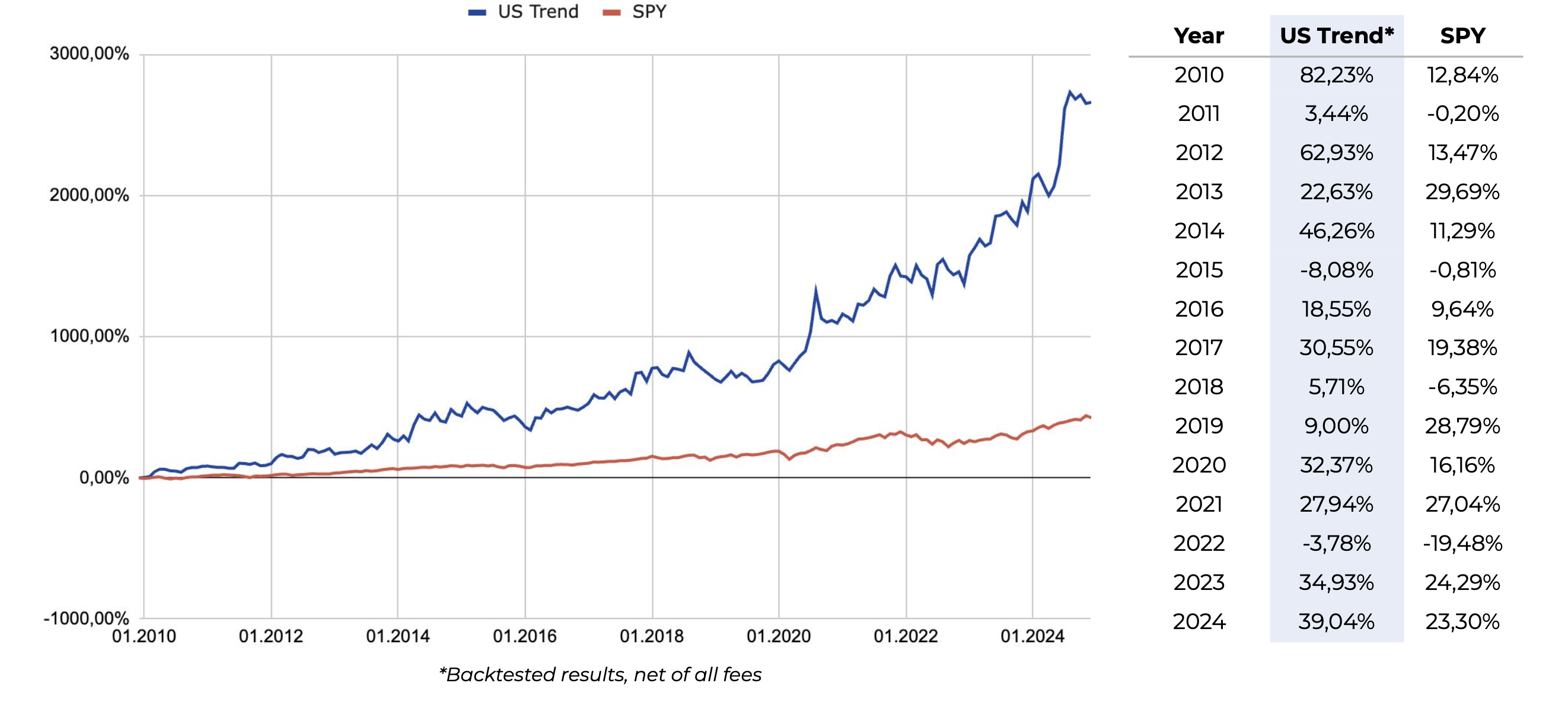

Achieve long-term asset growth outperforming the S&P 500 Index.

Investment strategyAsset management is based on fully automated quantitative long/short algorithmic strategies. Each model is tested on extensive historical data and validated through walk-forward analysis and Monte Carlo simulations. The portfolio focuses on the most liquid market instruments to ensure stability and efficiency.

Counterparties and exchanges

- Interactive Brokers

- Freedom Holding Corp.

- Turlov Family Office Securities

- Nasdaq

- NYSE

Trade Allocation

- TSLA - 30%

- NVDA - 30%

- AMD - 15%

- AAPL - 10%

- MSFT - 10%

Currency

- USD

100%

Liquidity

25%

Target annual net return

Fee

structure

Management fee: 2%. Performance fee: 30%. High water mark

Setup

structure

Ruthless calculation

Trends have been a fundamental aspect of financial markets for centuries, and a vast academic literature has been devoted to their persistence and influence. Our trend-following strategies use advanced computer algorithms to accurately identify trends, allowing them to trade hundreds of different markets simultaneously, removing biases caused by human emotions.

10%

~ volatility

$100,000

min investment amount

1+ year

optimal investment holding period

Daily

rebalancing

Proven reliability

Our systematic trend-following approach has proven itself for almost a decade, demonstrating its adaptability and reliability in a variety of market conditions. The strength of our strategy is due to its ability to profit from both uptrends and downtrends.

| CAGR | Volatility | Negative volatility | Max DD | Risk-free rate | Sharpe | Calmar | Sortino | β | |

| US Trend | 24,76% | 27,49% | 9,48% | -30,28% | 4,47% | 0,73 | 0,67 | 2,13 | 0,84 |

| SPY | 11,70% | 14,57% | 8,19% | -24,80% | 4,57% | 0,49 | 0,29 | 0,87 | 1 |

Bitcoin Hedge Strategy

Long-term asset value growth exceeding the increase in Bitcoin’s valuation against the US dollar

US Trend Strategy

Long-term asset value growth exceeding the return on the S&P500 Index

Crypto Trend Strategy

Our flagship active trend strategy for the digital assets market